Thank you in advance to some wise expertise from the ASA (American Staffing Association) and great input from multiple attorney friends in Houston, TX. Without your advice, it would be very difficult to answer this question. Thank you again.

Thank you in advance to some wise expertise from the ASA (American Staffing Association) and great input from multiple attorney friends in Houston, TX. Without your advice, it would be very difficult to answer this question. Thank you again.

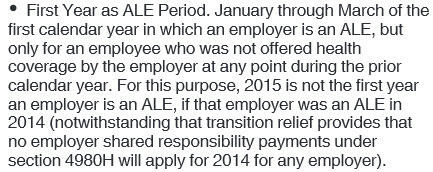

There is a transition relief within the ACA (Affordable Care Act) which states that a company will not be subject to tax penalties in Jan through March of their first year as an ALE (Applicable Large Employer) on any employees who were not offered insurance in the previous calendar year provided these employees are offered insurance on or before April 1st.

The question becomes, what is the definition of the ‘first year’?

It was obvious that in the case an employer was never an ALE before and is found to be an ALE in a given year, then that year was their first year as an ALE. But what wasn’t clear from the regulation was that given that 2015 is the first year most employers are doing the math, could 2015 be considered their ‘first year’? Many companies had accepted this as true and were planning on moving into 2015 with no plans to offer coverage before April 1. Was this acceptable within the regulations of the ACA? And maybe more importantly was this going to be acceptable to the government ACA enforcers, the IRS?

At first thought, this may seem to be acceptable. Companies were first doing the math in 2015, so they were going into 2015 for the first time as an ALE. In fact the IRS offered guidance (See F. Administrative Period http://www.irs.gov/irb/2014-9_IRB/ar05.html) which (to me and others) reinforced this by giving an example of a company that was allowed to take up to April 1st, 2015. The reasoning given was that the company would not know it was an ALE until it had a chance to review all the months in 2014 and would have no time to make the decision before Jan 1 to offer coverage and as such they were allowed to wait until April 1st. Many may have misread this to mean they must be allowing companies to measure all of 2014 before deciding if they are an ALE in 2015 and as such would need a few months to administer the change and offer coverage. What they failed to make clear in this example is that even though the employer mandate was pushed out to 2015, the requirement to determine your company’s ALE status in 2014 by analyzing 2013 was still in effect. So if a company is an ALE in 2014, they cannot be a new ALE in 2015. This is true even though the vast majority of companies had never done the math to determine 2014 status given the employer mandate has been pushed to 2015.

Thanks to some good advice, this interpretation was questioned. Companies could not consider 2015 their first year as an ALE simply because they were doing the math for the first time. They truly had to be defined as a non-ALE in 2014, then grow to ALE status in 2015 to enjoy this relief.

The IRS’s opinion on this subject is only clearly given in one place. The draft instructions for IRS Form 1095-C. On page 11 of this draft pdf, http://www.irs.gov/pub/irs-dft/i109495c–dft.pdf

To borrow from one of the email discussions on this subject: An instruction on a (draft) IRS form is a very low-level of legal authority, well behind the Constitution, the ACA statute, legislative history, final regulations, court cases, attorney general opinions, revenue rulings, and just about anything else you can think of for governmental guidance on the meaning of the law. Still, this tells you what the position of the IRS is likely to be, and no one should want to be the test case on such a position.

Stephen Schram is Principal, CTO with ACA Compliance Services Inc., author of Trax Compliance Software for Employers and frequent contributor to ASA Central Network. For questions regarding this article or general ACA compliance questions feel free to contact the author by email:

stephen.schram@trax-aca.com (

www.trax-aca.com)